Tax Reform Law 101: All you need to know

President Rodrigo Duterte signed into law the Tax Reform for Acceleration and Inclusion (TRAIN) on December 19, 2017. The tax reform, which took effect at the

start of 2018, is expected to generate almost P150 billion in revenues, which will be used for various infrastructure projects and social services.

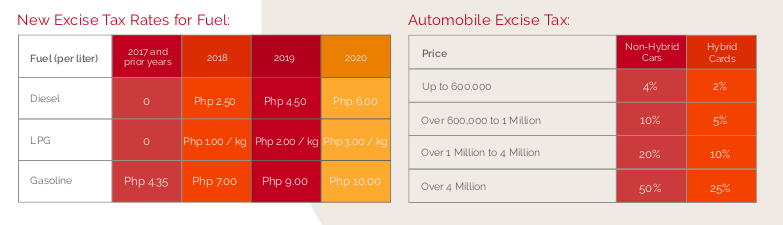

Among the implemented revenue enhancing measures were adjusting the excise taxes on fuel and automobiles and the broadening of the value-added tax base. Particularly for the oil and gas industry, the

new law also included the tax administration reform called the mandatory fuel marking program.

Slated to start within five years of the implementation of TRAIN, the fuel marking program calls for all petroleum products imported to or manufactured in the Philippines, to carry an official fuel marking technology that will ensure the payment of duties and taxes laid out in the TRAIN law. The program aims to curb oil smuggling, which is a rampant problem in the Philippines. The Department of Finance (DOF) expects the system to be in place by the second half of 2018.

WHERE THE TAXES WILL GO

- Infrastructure Programs

- Education

- Healthcare Services

In the next 5 years, the tax reform can fund:

- 35,745 km of paved roads or 786,400 km of temporary bridge upgrades or

2.6 million hectares of irrigated land. - 629,120 public school classrooms, or 2,685,101 public school teachers

- 60,483 rural health units, or 484,326 barangay health stations, or

1,324 provincial hospitals.